Digital Banking

On this page:

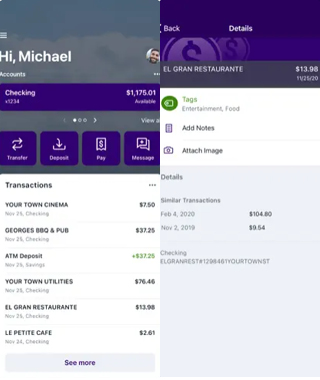

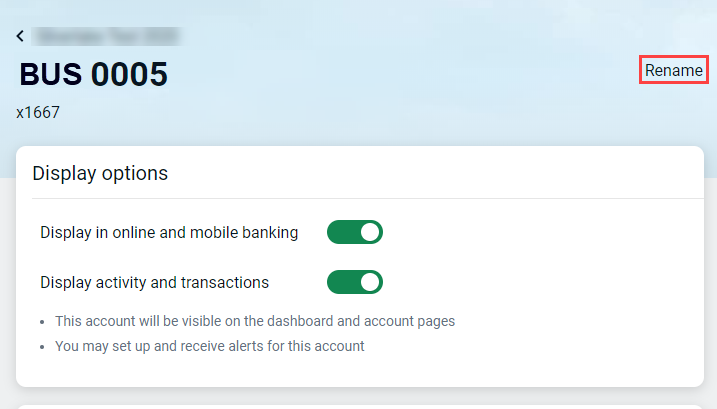

- Staying on top of your business's finances has never been easier

- Download the Citizens Bank Mobile App

- Special tools just for businesses to maximize cash flow

- Get started and learn about the most popular Digital Banking tools